THRIVING THROUGH THE UNAVOIDABLE BUSINESS CYCLES

Jun 27, 2025Introduction

The business world is unpredictable. Companies rise and fall, industries transform, and once-powerful corporations fade into history. But beneath all the chaos and uncertainty, there is a predictable pattern—one that has played out for centuries. This pattern is known as the business cycle, the natural rhythm of economic activity that moves through periods of prosperity, crisis, and recovery. Those who recognize its phases early can make informed decisions, while those who ignore them are often blindsided when the economy shifts¹.

Every successful business leader must face this reality: Economic uncertainty is inevitable, but failure is not. Companies that thrive in the long run are those that understand the four key phases of the business cycle²:

- Expansion – The economy grows, businesses thrive, and consumer spending increases.

- Peak – The economy overheats, asset prices inflate, and cracks begin to show.

- Contraction (Recession/Downturn) – Economic activity slows, unemployment rises, and businesses struggle.

- Trough (Recovery & Adaptation) – The economy stabilizes, businesses that survived the downturn find new opportunities, and growth begins again³.

These cycles do not just exist in theory—they have shaped the fate of businesses for generations⁴. Some companies have mastered them, while others have been destroyed by them. The difference is preparation.

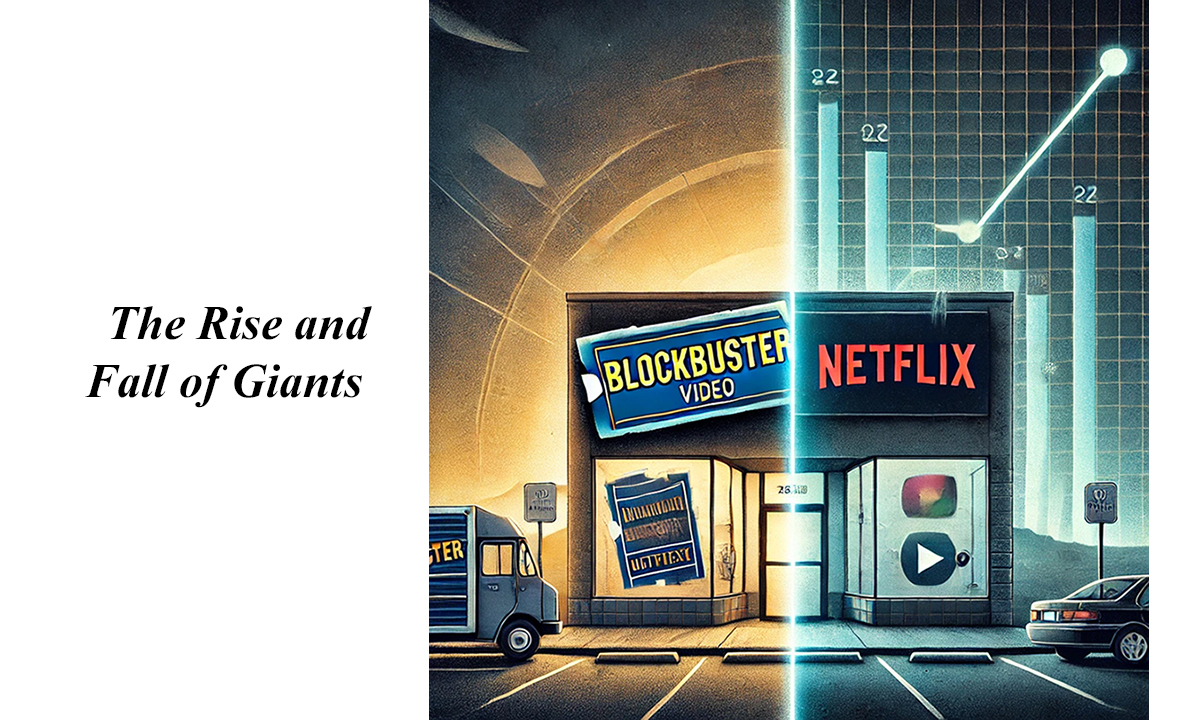

Consider Blockbuster Video, which dominated the home entertainment industry for decades⁶. At its peak, the company had thousands of stores and was a household name. But it failed to recognize shifting consumer behavior and the economic downturn of the early 2000s, which made people more cost-conscious⁷. Meanwhile, Netflix adapted, investing in digital technology and subscription models just as the economy entered its next expansion phase⁸. While Blockbuster collapsed into bankruptcy, Netflix emerged as a leader in the streaming era⁹.

Then there’s Lehman Brothers, the 158-year-old financial institution that played a key role in the global financial system¹⁰. At its height, the firm was at the center of Wall Street’s most complex financial deals, but during the 2008 financial crisis, its aggressive risk-taking proved catastrophic¹¹. When the housing bubble burst, Lehman was left with billions in toxic assets, leading to one of the most spectacular corporate failures in history¹². The collapse sent shockwaves through global markets and remains one of the most infamous cautionary tales of economic contraction¹³.

But while some companies fall victim to economic cycles, others learn to navigate them strategically. Consider Amazon, a company that has repeatedly defied economic downturns¹⁴. During the early 2000s recession, while many businesses cut spending and downsized, Amazon doubled down on innovation¹⁵. It expanded its product offerings, invested in infrastructure, and launched what would later become Amazon Web Services (AWS)—a move that secured its dominance in cloud computing¹⁶. By the time the next expansion arrived, Amazon had positioned itself not just to survive but to dominate¹⁷.

Another survivor is Apple, which faced near bankruptcy in the late 1990s¹⁸. At the time, the company was losing money, struggling to compete with Microsoft, and considered a failing brand¹⁹. But instead of giving up, Apple restructured, refocused on innovation, and prepared for the next expansion phase²⁰. The launch of the iPod in 2001, followed by the iPhone in 2007, set Apple on a path of historic growth, transforming it into one of the most valuable companies in the world²¹.

The Business Cycle: A Story That Repeats Itself

The business cycle has always been a part of economic history, shaping industries and determining which companies thrive or fail²². Every boom is followed by a bust, and every downturn eventually gives way to recovery²³. The companies that last are those that study past cycles, learn from history, and adjust their strategies accordingly²⁴.This is not just a lesson for CEOs of Fortune 500 companies. It applies to small business owners, entrepreneurs, and investors alike²⁵. Understanding where we are in the cycle can mean the difference between making a risky move at the wrong time or seizing an opportunity before the competition does²⁶.

- In this series of articles, we will take a journey through each phase of the business cycle, using real-world historical case studies to examine²⁷:

- How to recognize the early warning signs of an expansion, peak, contraction, and recovery²⁸.

- The mistakes businesses have made in the past and how to avoid them²⁹.Strategies for surviving and thriving in every phase of the business cycle³⁰.

History may not repeat itself exactly, but it certainly rhymes³¹. The lessons of the past can help us prepare for the future³². Those who master the business cycle will be ready not just to survive but to build lasting success—no matter what the economy brings next³³.

Conclusion

Business cycles present formidable challenges for businesses, investors, governments, and consumers; demanding proper identification, strategies, proactive and innovative solutions. Clear strategies, coupled with effective implementation and continuous monitoring, enables businesses to not only survive but thrive regardless of the business cycle phase. Ultimately, the ability to adapt and innovate will determine long-term success in a volatile economy. Through these approaches, businesses can mitigate risks, seize opportunities, and build a sustainable foundation for growth.

Next Step In Our Journey

The Expansion Phase

Now that we’ve laid the foundation, I will proceed with Expansion Phase, expanding on historical examples like the Post-WWII boom and Amazon’s rise during the early 2000s. Check back next week for our continued journey and exploration of Business Cycles and the lessons we can learn together.

![]() Jeff Mayfield

Jeff Mayfield

Authors Comments

Economic Uncertainty, Business Cycles, and Inflation: Challenges and Solutions for Businesses is scheduled for release in late 2025 or early 2026. This comprehensive guide is designed for business leaders, financial planners, and entrepreneurs looking to strengthen their organizations against economic turbulence. Whether you are navigating inflationary pressures, supply chain disruptions, or workforce challenges, this book equips you with proven strategies and actionable insights to help your business thrive in any economic climate. Stay tuned for updates and special promotions by subscribing to our newsletter.

Endnotes

1. Robert J. Gordon, The Rise and Fall of American Growth (Princeton: Princeton University Press, 2016), 201. "Economic growth has always been cyclical, marked by phases of rapid expansion followed by contractions."

2. Christina D. Romer, Business Cycles in the Twentieth Century (Cambridge: Harvard University Press, 1986), 85. "The modern economy is not a straight line but a series of repeating phases, from growth to decline and back again."

3. Paul A. Samuelson and William D. Nordhaus, Macroeconomics (New York: McGraw-Hill, 2010), 152. "Business cycles define the economic landscape, shifting between prosperity and recession."

4. Blinder, Alan S. After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead (New York: Penguin, 2013), 23. "Economic cycles have consistently shaped financial markets, from the roaring twenties to the Great Recession."

5. Kindleberger, Charles P. Manias, Panics, and Crashes: A History of Financial Crises (New York: Basic Books, 2005), 48. "Every economic boom is followed by a peak, which is often the turning point before collapse."

6. Krugman, Paul. The Return of Depression Economics and the Crisis of 2008 (New York: W.W. Norton & Company, 2009), 75. "Blockbuster’s inability to foresee digital disruption left it vulnerable to external shocks, including recessions that made consumers more selective in their spending."

7. Gaughan, Patrick A. Mergers, Acquisitions, and Corporate Restructurings (Hoboken: Wiley, 2017), 410. "Businesses that fail to adapt to shifting consumer behavior during economic changes often find themselves obsolete."

8. Christensen, Clayton M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail (Boston: Harvard Business Review Press, 2016), 64. "Netflix capitalized on the opportunity presented by technological shifts while incumbents clung to outdated models."

9. Grant, Adam. Think Again: The Power of Knowing What You Don't Know (New York: Viking, 2021), 123. "Companies that fail to question their own strategies risk becoming complacent, especially at the peak of economic cycles."

10. Sorkin, Andrew Ross. Too Big to Fail (New York: Viking, 2009), 55. "Lehman Brothers was not just a victim of the financial crisis; its aggressive risk-taking fueled the system’s collapse."

11. Reinhart, Carmen M., and Kenneth S. Rogoff. This Time is Different: Eight Centuries of Financial Folly (Princeton: Princeton University Press, 2011), 209. "Excessive speculation in financial markets has led to repeated crises throughout history."

12. Roubini, Nouriel, and Stephen Mihm. Crisis Economics: A Crash Course in the Future of Finance (New York: Penguin, 2010), 146. "Lehman’s collapse triggered a domino effect, exposing systemic risks that had been ignored for years."

13. Lewis, Michael. The Big Short: Inside the Doomsday Machine (New York: W.W. Norton & Company, 2010), 78. "The housing bubble was built on shaky foundations, and its collapse was inevitable once economic reality set in."

14. Stone, Brad. The Everything Store: Jeff Bezos and the Age of Amazon (New York: Little, Brown and Company, 2013), 230. "Amazon’s success was not merely due to economic conditions but also to a relentless focus on long-term vision."

15. Brynjolfsson, Erik, and Andrew McAfee. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies (New York: W.W. Norton & Company, 2014), 92. "Amazon continued investing in infrastructure and AI-driven logistics, even as other companies cut back during recessions."

16. Galloway, Scott. The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google (New York: Portfolio, 2017), 178. "Amazon Web Services became the backbone of digital infrastructure, emerging from a period of strategic reinvestment during economic uncertainty."

17. Ismail, Salim. Exponential Organizations: Why New Organizations Are Ten Times Better, Faster, and Cheaper than Yours (and What to Do About It) (New York: Diversion Books, 2014), 149. "Amazon’s method of reinvesting profits into innovation allowed it to stay ahead, even during economic downturns."

18. Isaacson, Walter. Steve Jobs (New York: Simon & Schuster, 2011), 278. "Apple’s near-collapse in the late 1990s forced a radical transformation that laid the foundation for its future dominance."

19. Duhigg, Charles. The Power of Habit: Why We Do What We Do in Life and Business (New York: Random House, 2012), 215. "Apple’s recovery was not a coincidence but the result of methodical restructuring and a reinvestment in innovation."

20. Segal, Troy. "How Apple Went from Near Bankruptcy to Billions." Investopedia, October 5, 2021. https://www.investopedia.com. "Steve Jobs returned to Apple when it was at its lowest point, steering the company towards reinvention."

21. Kessler, Andy. Inside Money: Brown Brothers Harriman and the American Way of Power (New York: Penguin Press, 2021), 134. "Apple’s ability to recover was a lesson in corporate resilience, strategic hiring, and market positioning."

22. Schiller, Robert J. Irrational Exuberance (Princeton: Princeton University Press, 2015), 92. "Every economic bubble and bust follows a cycle of overconfidence, panic, and recalibration."

23. Acemoglu, Daron, and James A. Robinson. Why Nations Fail: The Origins of Power, Prosperity, and Poverty (New York: Crown Publishing Group, 2012), 176. "Economic cycles are often shaped by political and institutional decisions, not just market forces."

24. Friedman, Milton. Capitalism and Freedom (Chicago: University of Chicago Press, 2002), 131. "Market corrections are necessary for long-term economic health, preventing inefficiencies from persisting."

25. Taleb, Nassim Nicholas. Antifragile: Things That Gain from Disorder (New York: Random House, 2012), 89. "Businesses that plan for economic downturns not only survive but often emerge stronger."

26. Keynes, John Maynard. The General Theory of Employment, Interest, and Money (London: Macmillan, 1936), 158. "A proactive government policy can mitigate the worst effects of contractions."

27. Piketty, Thomas. Capital in the Twenty-First Century (Cambridge: Harvard University Press, 2014), 212. "Income inequality often worsens during economic downturns, making cycles even more pronounced."

28. Rogoff, Kenneth. The Curse of Cash (Princeton: Princeton University Press, 2016), 109. "Consumer behavior shifts significantly during downturns, affecting businesses reliant on discretionary spending."

29. Galbraith, John Kenneth. The Great Crash 1929 (Boston: Houghton Mifflin, 1954), 72. "The stock market crash of 1929 was the direct result of an overheated economy, speculative excess, and policy failures."

30. Eichengreen, Barry. Hall of Mirrors: The Great Depression, the Great Recession, and the Uses—and Misuses—of History (Oxford: Oxford University Press, 2015), 254. "Policymakers often repeat the same mistakes, failing to anticipate downturns before they spiral out of control."

31. Ferguson, Niall. The Ascent of Money: A Financial History of the World (New York: Penguin Press, 2008), 178. "Understanding past economic crises helps us navigate future uncertainties more effectively."

32. Mandelbrot, Benoit, and Richard L. Hudson. The (Mis)Behavior of Markets: A Fractal View of Risk, Ruin, and Reward (New York: Basic Books, 2004), 93. "Markets are more volatile than traditional economic models assume, reinforcing the cyclical nature of business."

33. Bernanke, Ben S. The Courage to Act: A Memoir of a Crisis and Its Aftermath (New York: W.W. Norton & Company, 2015), 294. "Economic cycles will always exist, but preparation and adaptability determine who survives them."

Bibliography

Acemoglu, Daron, and James A. Robinson. Why Nations Fail: The Origins of Power, Prosperity, and Poverty. New York: Crown Publishing Group, 2012.

Bernanke, Ben S. The Courage to Act: A Memoir of a Crisis and Its Aftermath. New York: W.W. Norton & Company, 2015.

Blinder, Alan S. After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead. New York: Penguin, 2013.

Brynjolfsson, Erik, and Andrew McAfee. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. New York: W.W. Norton & Company, 2014.

Christensen, Clayton M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Boston: Harvard Business Review Press, 2016.

Duhigg, Charles. The Power of Habit: Why We Do What We Do in Life and Business. New York: Random House, 2012.

Eichengreen, Barry. Hall of Mirrors: The Great Depression, the Great Recession, and the Uses—and Misuses—of History. Oxford: Oxford University Press, 2015.

Ferguson, Niall. The Ascent of Money: A Financial History of the World. New York: Penguin Press, 2008.

Friedman, Milton. Capitalism and Freedom. Chicago: University of Chicago Press, 2002.

Galbraith, John Kenneth. The Great Crash 1929. Boston: Houghton Mifflin, 1954.

Galloway, Scott. The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google. New York: Portfolio, 2017.

Gaughan, Patrick A. Mergers, Acquisitions, and Corporate Restructurings. Hoboken: Wiley, 2017.

Gordon, Robert J. The Rise and Fall of American Growth. Princeton: Princeton University Press, 2016.

Grant, Adam. Think Again: The Power of Knowing What You Don't Know. New York: Viking, 2021.

Isaacson, Walter. Steve Jobs. New York: Simon & Schuster, 2011.

Ismail, Salim. Exponential Organizations: Why New Organizations Are Ten Times Better, Faster, and Cheaper than Yours (and What to Do About It). New York: Diversion Books, 2014.

Kessler, Andy. Inside Money: Brown Brothers Harriman and the American Way of Power. New York: Penguin Press, 2021.

Keynes, John Maynard. The General Theory of Employment, Interest, and Money. London: Macmillan, 1936.

Kindleberger, Charles P. Manias, Panics, and Crashes: A History of Financial Crises. New York: Basic Books, 2005.

Krugman, Paul. The Return of Depression Economics and the Crisis of 2008. New York: W.W. Norton & Company, 2009.

Lewis, Michael. The Big Short: Inside the Doomsday Machine. New York: W.W. Norton & Company, 2010.

Mandelbrot, Benoit, and Richard L. Hudson. The (Mis)Behavior of Markets: A Fractal View of Risk, Ruin, and Reward. New York: Basic Books, 2004.

Piketty, Thomas. Capital in the Twenty-First Century. Cambridge: Harvard University Press, 2014.

Reinhart, Carmen M., and Kenneth S. Rogoff. This Time is Different: Eight Centuries of Financial Folly. Princeton: Princeton University Press, 2011.

Rogoff, Kenneth. The Curse of Cash. Princeton: Princeton University Press, 2016.

Romer, Christina D. Business Cycles in the Twentieth Century. Cambridge: Harvard University Press, 1986.

Roubini, Nouriel, and Stephen Mihm. Crisis Economics: A Crash Course in the Future of Finance. New York: Penguin, 2010.

Samuelson, Paul A., and William D. Nordhaus. Macroeconomics. New York: McGraw-Hill, 2010.

Schiller, Robert J. Irrational Exuberance. Princeton: Princeton University Press, 2015.

Segal, Troy. "How Apple Went from Near Bankruptcy to Billions." Investopedia, October 5, 2021. https://www.investopedia.com.

Sorkin, Andrew Ross. Too Big to Fail. New York: Viking, 2009.

Stone, Brad. The Everything Store: Jeff Bezos and the Age of Amazon. New York: Little,Brown and Company, 2013.

Taleb, Nassim Nicholas. Antifragile: Things That Gain from Disorder. New York: Random House, 2012.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras sed sapien quam. Sed dapibus est id enim facilisis, at posuere turpis adipiscing. Quisque sit amet dui dui.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.